Understanding how an RBA cash rate cut works is essential for Australians. It influences borrowing costs, savings returns, and overall economic activity.

Understanding the Cash Rate

The cash rate is the interest rate at which banks lend and borrow funds from each other overnight. It serves as the benchmark for interest rates across the economy, influencing the rates that financial institutions offer on loans and deposits. The RBA sets a target for the cash rate to achieve its monetary policy objectives, primarily focusing on price stability and full employment.

The RBA’s Monetary Policy Framework

The RBA employs monetary policy to manage economic growth and inflation. By adjusting the cash rate target, the RBA influences economic activity to maintain inflation within its target range of 2–3%. Lowering the cash rate can stimulate economic growth by making borrowing cheaper, encouraging spending and investment.

Implementation of a Cash Rate Cut

When the RBA decides to cut the cash rate, it follows a structured process to ensure the new rate is effectively transmitted through the financial system.

Announcement of the Rate Cut

The process begins with the RBA announcing its decision to lower the cash rate target. This announcement is made after the monthly board meeting and is closely watched by financial markets, businesses, and consumers.

Adjusting the Policy Interest Rate Corridor

To implement the new cash rate target, the RBA adjusts the policy interest rate corridor. This corridor consists of:

- Deposit Rate: The interest rate the RBA pays on Exchange Settlement (ES) balances held by banks, set slightly below the cash rate target.

- Lending Rate: The rate at which the RBA lends to banks overnight, set above the cash rate target.

By narrowing or widening this corridor around the new cash rate target, the RBA influences the incentives for banks to lend or borrow funds, guiding the market towards the desired cash rate.

Open Market Operations

The RBA conducts open market operations (OMOs) to manage the supply of ES balances in the banking system. Through OMOs, the RBA engages in transactions such as:

- Repurchase Agreements (Repos): The RBA buys government securities from banks with an agreement to sell them back at a later date, injecting liquidity into the system.

- Outright Transactions: The outright purchase or sale of government securities to permanently adjust the level of ES balances.

These operations help maintain the cash rate at the target level by ensuring an appropriate supply of funds in the interbank market.

Transmission to the Broader Economy

A reduction in the cash rate sets off a chain reaction throughout the economy, influencing various financial variables and behaviours.

Impact on Financial Institutions

Banks and other financial institutions respond to a lower cash rate by adjusting their own interest rates. This typically results in:

- Lower Lending Rates: Reduced interest rates on mortgages, personal loans, and business loans, making borrowing more attractive.

- Lower Deposit Rates: Decreased returns on savings accounts and term deposits, which may discourage saving in favour of spending or investment.

Effect on Borrowers and Consumers

For individuals and businesses, a cash rate cut can have several implications:

- Reduced Loan Repayments: Existing borrowers with variable-rate loans may see a decrease in their monthly repayments, freeing up disposable income.

- Increased Borrowing Capacity: Lower interest rates can enhance the affordability of new loans, encouraging additional borrowing for housing, investment, or consumption.

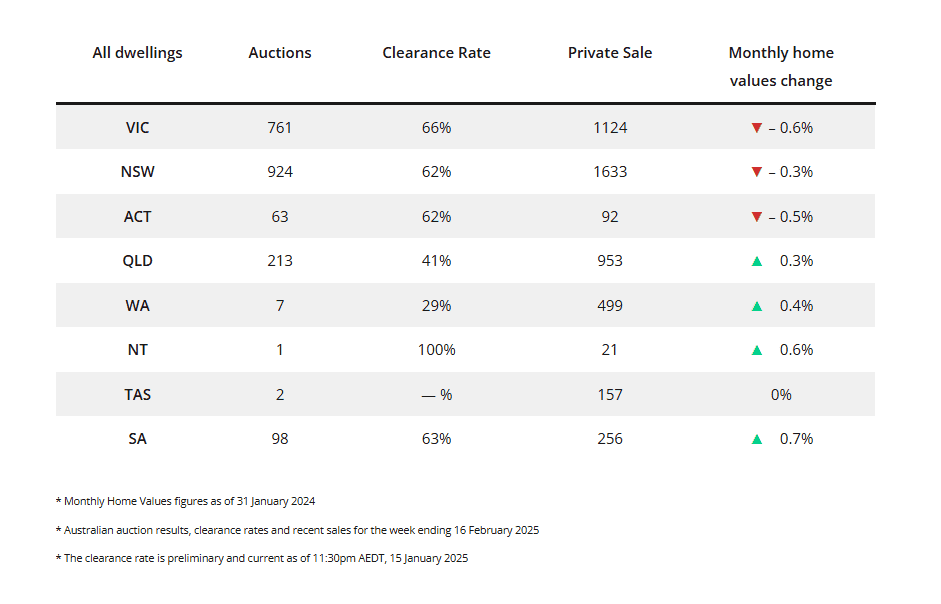

Influence on the Housing Market

The housing market often experiences notable effects following a cash rate cut:

- Increased Demand: Cheaper borrowing costs can lead to heightened demand for property, potentially driving up housing prices.

- Investor Activity: Lower interest rates may attract investors seeking higher returns, further stimulating the property market.

Stimulus to Economic Activity

By reducing the cash rate, the RBA aims to stimulate overall economic activity:

- Boost in Consumer Spending: Lower borrowing costs and reduced incentives to save can lead to increased consumer expenditure.

- Encouragement for Business Investment: Businesses may be more inclined to invest in expansion and capital projects due to cheaper financing options.

Potential Risks and Considerations

While cash rate cuts are designed to stimulate the economy, they come with potential risks:

- Asset Price Inflation: Excessive borrowing can lead to inflated asset prices, creating bubbles in markets such as real estate.

- Household Debt Levels: Lower interest rates might encourage higher household debt, which can be problematic if rates rise in the future or if economic conditions deteriorate.

Recent Developments and Outlook

As of March 2025, Australia’s inflation rate has shown signs of easing, with the Consumer Price Index (CPI) indicating a downward trend. This development has led to renewed speculation about potential rate cuts by the RBA. However, economists suggest that while the lower inflation figures provide room for monetary easing, the RBA may adopt a cautious approach, awaiting more comprehensive data before implementing further rate cuts. Factors such as global economic uncertainties and domestic labour market conditions will likely influence the timing and magnitude of any future adjustments to the cash rate.

Conclusion

The RBA’s decision to cut the cash rate is a strategic move aimed at stimulating economic activity by lowering borrowing costs and encouraging spending and investment. Understanding the mechanics of how a cash rate cut works helps Australians grasp its impact on their finances, the housing market, and the broader economy.